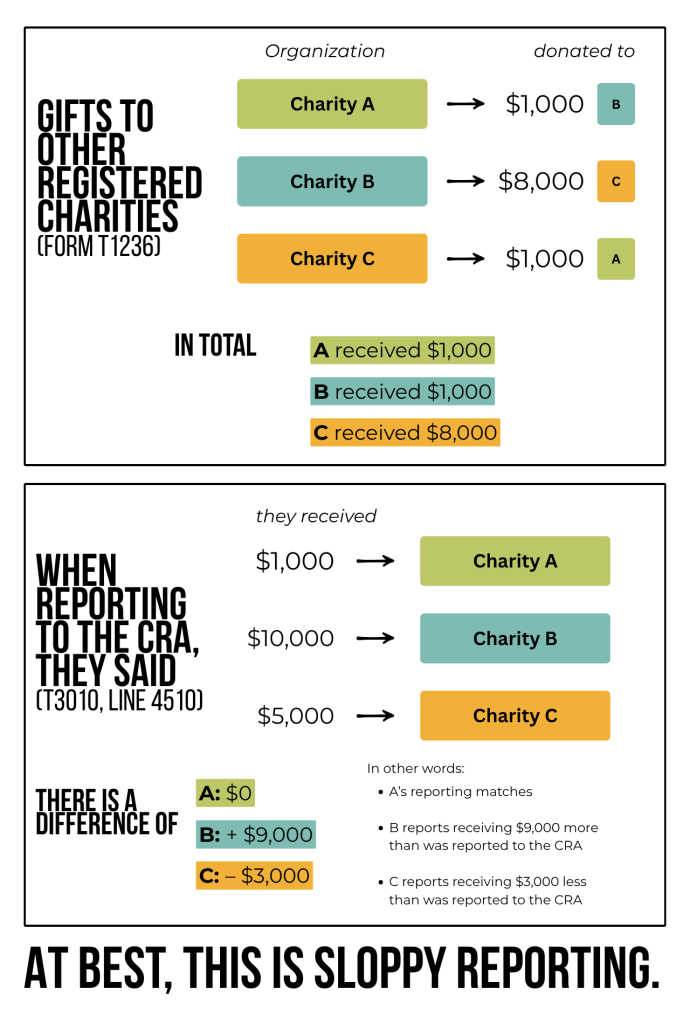

According to charitable filings from the Canada Revenue Agency (CRA) between 2003 and 2024, there are serious discrepancies between how much charities are reporting to give to another charity, and how much each charity is receiving. Let’s break this down. Charities must report the total amount received from other registered charities on their tax returns (T3010, Line 4510). Charities also need to report to whom and how much they donate to other registered charities (Form T1236). Theoretically, the total amount a charity reports receiving on Line 4510 should match the total amount all other registered report giving on Form T1236. For a graphic reference, check out the image at the bottom of this post.

Our findings

However, what we have found is quite different. In total, we identified $101,560,585,842 or over $101 billion missing. Some organizations reported receiving more than other charities reported on the T1236. In contrast, other organizations reported receiving less.

This is clearly a systemic issue. Of the 121,770 charities listed in the dataset, we flagged 93,849 as having discrepancies. While some were simply $1 or $100 difference, in many cases it was in the hundreds of thousands, millions, and sometimes billions. For instance, of the 93,849 charities we flagged, 81,085 had $1,000 or more missing.

11 charities with over $1 billion missing

These discrepancies are not isolated to any particular type(s) of registered charities. When considering only the biggest 11 discrepancies (all of which are over $1 billion), they include healthcare organizations, government agencies, religious institutions, a school, and a conservation charity.

Pro-Israel charities are not exempt

Many of the organizations are universities, healthcare institutions including hospitals, and religious institutions. This is unsurprising when considering there are nearly 100,000 charities with discrepancies. This includes various organizations that support Israel’s apartheid, occupation, and genocide. While not a full analysis, we provide a small sample of discrepancies we have noted for various Zionist organizations:

- Jewish National Fund

- United Jewish Appeal of Greater Toronto

- The Friedberg Charitable Foundation

- Jewish Heritage Foundation of Canada (now Moral Arc Foundation)

- Ne`eman Foundation Canada

- The Canadian Friends of the Hebrew University

- International Fellowship of Christians and Jews

- Canadian Magen David Adom for Israel

- HESEG Foundation

- United Israel Appeal of Canada

CRA response

We contacted the CRA with our concerns and received the following response:

A graphic representation of the missing funds