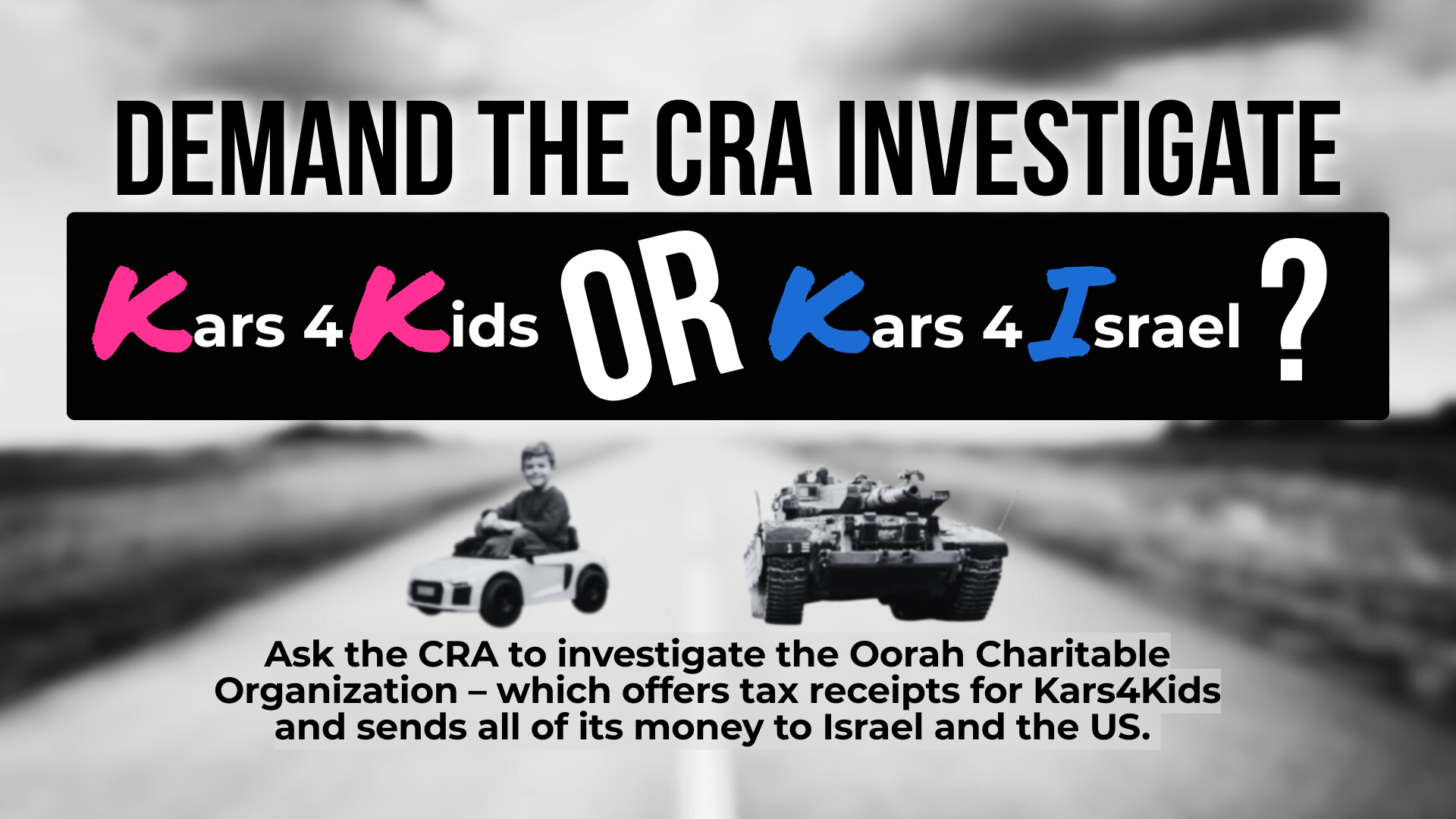

Another possible abuse of charitable registration which requires investigation to determine eligibility and compliance with Canada’s charities regulations.

It involves an organization named “Kars4Kids Canada” (https://www.kars4kids.org/en-ca/) which operates a car donation service in Canada and provides tax-deductible receipts through a separate but related entity named “Oorah Charitable Organization” (807556071 RR0001).

It appears that Kars4Kids Canada operates as an arm of a similar service and organization in the U.S., where Oorah Kiruv Rechokim, Inc. the U.S. religious organization runs day camps exclusively for Jewish children and youth. Oorah/Kars4Kids was founded in 1994 in Lakewood, New Jersey, by Chaim Mintz, and is currently run by his son, Eliyahu Mintz, who is on the board of directors of the Oorah Charitable Organization in Canada.

Kars4Kids’ stated mission is “to fund educational, developmental, and recreational programs for low-income youth.” Kars4Kids has been accused of false advertising as the kids the charity helps are exclusively Jewish kids who live in and around Lakewood. Kars4Kids has been fined in several U.S. states for misleading practices and for failing to disclose their religious affiliation and the fact that the donations mostly go to serve kids in a very limited area of the U.S. where Oorah is located, in New Jersey. Also, Kars4Kids has been found to use a substantial amount of assets on failed real estate deals, including two high-rises in New Jersey, a Staten Island outlet mall and a mixed-use project in Jerusalem.

In Canada, Kars4Kids is associated with “Oorah Charitable Organization / Oeuvre De Bienfaisance Oorah”, an Ontario corporate registration based in Toronto. Kars4Kids accepts car donations, offering free towing and tax-deductible receipts from Oorah. Kars4Kids, despite having a separate Ontario registration, promotes its tax receipts on the Kars4Kids website using Oorah’s charity business number. Oorah shows no staff on its CRA charity filings. This is odd, given that the operation of a car donation business requires promoting, obtaining, towing, fixing, reselling cars, and issuing tax receipts.

Kars4Kids Canada, like its U.S. counterpart, has faced criticism over key issues including: transparency of the religious and geographic focus of its programs, the transfer of funds to Oorah Inc. charity in U.S., and misleading advertising. Most donors of cars in Canada are not aware that Kars4Kids funds educational, mentorship, and support programs exclusively to Orthodox Jewish youth both in the U.S. and in Israel. There is no indication that any funds are going towards serving kids in Canada.

The site, Charity Intelligence, has given Oorah Charitable Organization/Kars4Kids Canada, only a 1-star rating for Financial Transparency and an F for reporting results.

A review of CRA filings shows donations received by Oorah Canada are going entirely to Israel and the U.S. – something not mentioned on its website or in its prolific social media ads. These include religious programs for post-secondary education (a Yeshiva), along with high schools in the U.S, and also what appears to be an Israel-based “matchmaking” service.

Millions of dollars are being sent abroad without providing a comprehensive list of all donee entities with the respective amount received. It is not clear how Oorah Canada maintains oversight or direction over the funds they are transferring to Israel and the US. This operational oversight is a strict requirement for Canadian charities.

Further, CRA data shows that Oorah Charitable Organization equity has increased by $8.4 million in the past five years. This would indicate funds raised are used for tax sheltering rather than directing towards programs.

Based on this information, we urge CRA to investigate Oorah Charitable Organization regarding:

- relationship with Kars4Kids Canada

- transparency, oversight and reporting of operations and finances

- funds sent to Israel, including possible support of illegal settlements and/or the Israeli military

- misleading nature of the organization in its advertising and publicly available information which misrepresent or hide the exclusive nature of narrow set of beneficiaries to the exclusion of others.

Canada’s charity sector must maintain integrity if it is to have the confidence of the Canadian public.